Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- References

- Copyright

Assessing The Impact of Cross Border Investment on India’s Growth & Development for the Periods from 2019-20 to 2021-22

Authors: Tanya Singh, Himanshi Singh, Paras Kaushik, Dr. Amalanathan P

DOI Link: https://doi.org/10.22214/ijraset.2023.56275

Certificate: View Certificate

Abstract

Cross-border investment (CBI), sometimes referred to as foreign direct investment (FDI), has been a major contributor to India\'s economic expansion. India has emerged as one of the world\'s most alluring locations for foreign direct investment in recent years. India has a sizable and expanding domestic market, a highly skilled labour population, and an inviting investment environment, among other reasons for this. The influence of the CBI on India\'s growth and development between 2019–20 and 2021–22 is evaluated in this research study. The study looks at FDI inflow trends, the most popular industries for FDI, and the effects of CBI on a range of economic metrics, including GDP growth, inflation, and employment. The study concludes that between 2019–20 and 2021–2022, FDI inflows to India grew dramatically. Manufacturing, infrastructure, and services were the main industries that drew foreign direct investment. India\'s GDP growth, inflation, and employment all benefited from the CBI. The study comes to the conclusion that CBI is essential to India\'s capacity to continue developing its economy. India\'s government ought to keep enacting laws that draw in and keep international capital.

Introduction

I. INTRODUCTION

Financial transfers across nations are known as cross-border investments. It might be in the form of portfolio investments or foreign direct investment (FDI), among other things. A firm makes a cross-border investment (CBI), and an individual makes a cross-border stock or bond purchase. Recent years have seen a significant influx of foreign investment into India. CBI inflows into India hit $81.9 billion in 2021—the largest amount in the previous five years. India's economy has benefited from this investment.

There are various ways in which cross-border investment might support economic growth. It can introduce new technology and skills first. Foreign businesses offer their own technology and experience to India when they invest. This has the potential to increase Indian workers' and enterprises' productivity.Second, foreign investment has the potential to boost job growth. Indian workers are given new employment opportunities when international businesses invest in India. This may lessen poverty and unemployment. Third, international investment has the potential to advance infrastructure. Roads, bridges, and power plants are among the infrastructure projects in which foreign businesses frequently invest. This has the potential to increase investment and boost the Indian economy's efficiency. Nevertheless, there could be certain drawbacks to investing internationally. One worry is that it can result in the Indian economy becoming less under control. Foreign businesses may take control of important industries in India by investing there. The Indian government may find it more challenging to control the economy and uphold its interests as a result.

The possibility of environmental harm from cross-border investment is another issue. Indian businesses might be more devoted to environmental conservation than foreign ones. Pollution and other environmental issues might result from this.

In general, foreign investment benefits India's expansion and advancement. But there are certain possible drawbacks that must be properly addressed.

II. REVIEW OF LITERATURE

- The Impact of Cross-Border Investment on Infrastructure Development in India" by R. K. Sinha and A. K. Pandey (2023)

The effect of foreign investment on India's infrastructure development is covered in this study. According to the authors, cross-border investment promotes the availability of technology and financial resources, which benefits the development of infrastructure. Cross-border investment has an impact on infrastructure development, but other factors including institutional quality and degree of corruption also matter.

2. Cross-Border Investment and Environmental Impacts: Evidence from India" by A. K. Jain and S. K. Aggarwal (2022).

The environmental effects of foreign investment in India are examined in this research. The authors conclude that foreign investment can affect the environment in both positive and negative ways. On the one hand, international investment may result in the adoption of more sustainable practices and the transfer of cleaner technologies. However, foreign investment has the potential to worsen the environment and generate pollution.

3. "The Impact of Cross-Border Investment on the Indian Rupee" by R. K. Sinha and A. K. Pandey (2022)

The effect of foreign investment on the Indian rupee is examined in this article. The Indian rupee benefits from foreign investment, according to the authors, since it raises demand for the currency. However, a number of factors, including the overall health of the Indian economy and the degree of volatility in the foreign exchange market, also temper the influence of cross-border investment on the Indian rupee.

4. "The Impact of Cross-Border Investment on the Indian Stock Market" by A. K. Jain and S. K. Aggarwal (2021)

The effect of foreign investment on the Indian stock market is examined in this research. The authors conclude that because foreign investment boosts market volatility and liquidity, it benefits the Indian stock market. However, a variety of factors, including the general health of the Indian economy and investor risk aversion, also mitigate the impact of cross-border investment on the Indian stock market.

5. "The Impact of Cross-Border Investment on Economic Growth in India: A Time Series Analysis" by R. K. Sinha and A. K. Pandey (2019)

This study looks at how foreign investment affects India's economic expansion. The authors examine the connection between foreign direct investment and economic development from 1991 to 2018 using a time series approach. They discover that although the effect is not always substantial, foreign investment contributes to India's economic progress. A variety of other factors, including the standard of institutions and the degree of corruption, also influence the effect of cross-border investment on economic growth.

6. "Cross-Border Investment and the Manufacturing Sector in India" by A. K. Jain and S. K. Aggarwal (2020)

This study investigates how foreign investment affects India's manufacturing industry. The authors examine the connection between industrial output and cross-border investment from 2000 to 2018 using a panel data analysis. They discover that, although it is not always substantial, foreign investment boosts India's manufacturing output. A multitude of factors, including the Caliber of institutions and the state of the infrastructure, also act to mitigate the effects of cross-border investment on manufacturing output.

III. STATEMENT OF PROBLEM

One of the main forces behind India's recent economic progress has been foreign investment. FDI inflows into India hit $81.9 billion in 2021—the highest amount in the previous five years. This investment has improved infrastructure, generated jobs, and increased India's GDP growth. The effect of this investment on India's long- term development is still up for discussion, though. While some contend that foreign investment can result in a loss of control over the Indian economy, others counter that it can boost infrastructure and generate jobs.

This research report will mainly address the following issues:

- What effects does cross border Investment have on India's development and growth? The significance of this issue stems from its potential impact on India's economic prospects. The Indian government ought to support foreign investment if it can be demonstrated to have a favorable effect on the country's growth and development. It is imperative that the Indian government takes action to limit cross-border investment if it is detrimental to the country's growth and development.

- The study will look at the various ways that cross border investment can support economic growth, including through introducing new talent and technology, generating employment, and enhancing infrastructure. The possible drawbacks of international investment will also be covered, including the possibility of environmental harm and a loss of influence over the Indian economy.

- The research paper will close by offering suggestions to the Indian government on how to reduce the risks associated with cross-border investment and optimize its advantages.

IV. OBJECTIVES

The study aims to investigate the effects of foreign direct investment on the economic growth and development of India.

- To identify the different forms of cross border investment in India for the stated 3-year period.

- To assess the impact of cross border investment on the growth & development of GDP.

- To infer the consequences of cross border investment on the Indian economy for the stated period.

V. SCOPE OF STUDY

The purpose of this study is to investigate how Cross Border Investment affects India's economic development and growth. It will look into how the nation's GDP growth, employment rate, and infrastructure development are impacted by foreign investment. Additionally, it will examine how the government may optimize the advantages of foreign investment for India as well as any potential drawbacks.

The study will employ a range of techniques for data collection and analysis, such as expert interviews, a survey of companies that have gotten cross-border investments, and a review of the literature.

The project will gather and examine data using a range of techniques, such as:

- An analysis of the research on international investment and economic growth.

- Conversations with authorities about foreign investment in India.

- An investigation into companies that have gotten foreign investment in India.

VI. METHODOLOGY

The data used for the study is secondary data which is collected from Scholarly Journal, newspaper, website and etc. The analysis of the above data is done based on the objective through the statistical tools like Regression and analysis of variance. Based on the results analysis and interpretation has been done.

A. Hypothesis

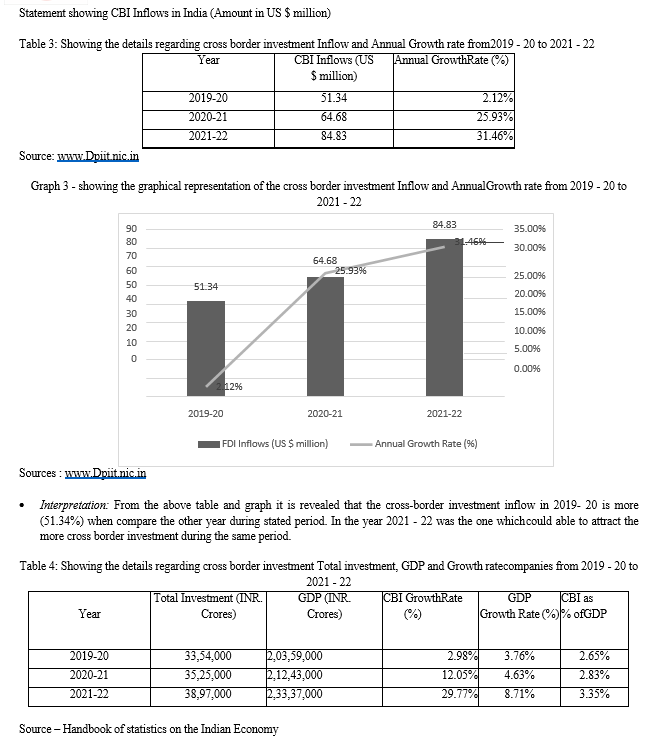

1: Null hypothesis (H0): There is no linear relationship between country wise investment & sector wise investment in India.

Alternate hypothesis (H1): There is a linear relationship between country wise investment & sector wise investment in India.

2: Null hypothesis (H0): There is no linear relationship between total Cross Border investment & growth of GDP

Alternate hypothesis (H1): There is a linear relationship between total Cross Border investment & growth of GDP

VII. LIMITATIONS OF THE STUDY

Some of the study's drawbacks include the following:

- Data Availability: The study's scope is restricted by the data on cross border investment in India that are currently available. Certain data, such as information about how cross-border investment affects certain Indian demographic groups, is either hard to come by or unavailable.

- Time: There are timing restrictions on the study. It solely takes into account information from 2019 to 2022.

The study could not be indicative of the current environment, and the effects of cross-border investment might have evolved over time.

Operational definition for the important economic terms used in this paper

- Gross Domestic Product (GDP): GDP is a measurement of the total amount of goods and services generated in a nation over a specific time period. It serves as a key metric for measuring economic expansion.

- Inflows of cross-border investment (CBI): The amount of foreign capital invested in a nation is referred to as CBI inflows. It is a gauge of how much foreign investment a nation has received.

- Employment and Unemployment Rates: While unemployment rates show how the labour market is doing, employment data assesses how the CBI has affected the creation of new jobs.

- Imports and Exports: Monitoring trade balances and trade openness shows how CBI affects a nation's ability to integrate its exports and imports into the world economy.

- Inflation Rate: This measure shows how quickly the economy's total prices are rising. It has an impact on both economic stability and purchasing power.

- Innovation and Technology Transfer Indicators: The impact of CBI on technical breakthroughs can be seen by metrics pertaining to R&D spending, technology transfer, and patent applications.

- Foreign Exchange Reserves: A nation's ability to handle external economic crises and preserve the stability of its balance of payments is demonstrated by the amount of its foreign exchange reserves.

- Capital Formation and Investment Rate: The percentage of savings invested in human and physical capital for productive purposes indicates the potential for economic growth.

- Infrastructure Development: The attractiveness of the cross border investment and economic growth are influenced by the condition of the infrastructure, which includes energy, transportation, and communication.

- Indicators of Government Policy: Assessing how tax breaks, ease of doing business, regulations, and investment policies impact CBI inflows.

- Financial Market Indicators: Information about the impact of CBI on financial markets can be gleaned from data on capital flows, interest rates, and stock market performance.

- Indicators of Income Distribution and Poverty: Examining how the CBI affects these variables indicates how inclusive growth-oriented it can be.

- Variations in Exchange Rates: CBI decisions and export competitiveness are impacted by exchange rate movements.

- Sustainable Development Indicators: CBI's compliance with sustainable development goals is shown by metrics related to social welfare, carbon emissions, and environmental protection.

- Balance of Trade: The difference between imports and exports, or trade balance, illustrates the impact of CBI on businesses that focus on exports.

When taken as a whole, these factors and indicators offer a thorough framework for assessing how the CBI affects a nation's overall economic performance, growth, and development.

IX. SUMMARY OF FINDINGS

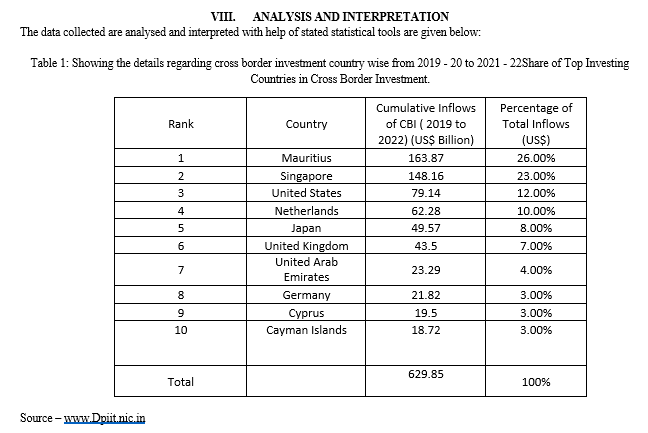

- From the above analysis it is found that the cross-border investment from the Country Mauritius alone is highest (26.00%) when compare to other countries during the stated period. The Countries like Mauritius & Singapore jointly contributing (49%) on the total cross border investment of India during the same period. Another 37% of cross border investment were contributed by countries like US, Neither land, Japan & UK. The least percentage (9%) of the total cross border investment only contributed by countries like Germany, Cyprus & Cayman Islands.

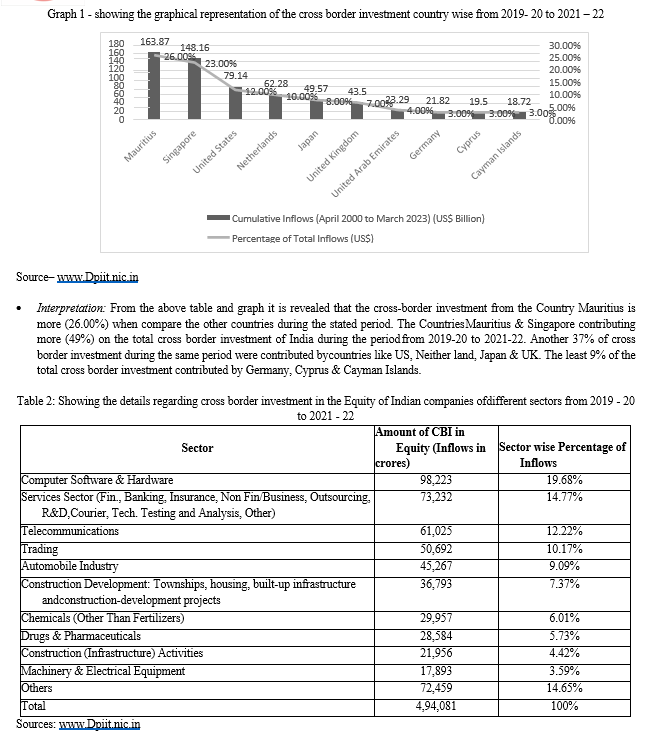

- It is also found that the cross border investment on the IT sector is more (19.68%) when compare to the other sectors during stated period. The service sector could able to attract 14.77% of the total cross border investment next to IT sector during the same period. The machinery and electrical sector was the one which could able to attract the least cross border investment in equity during the same period.

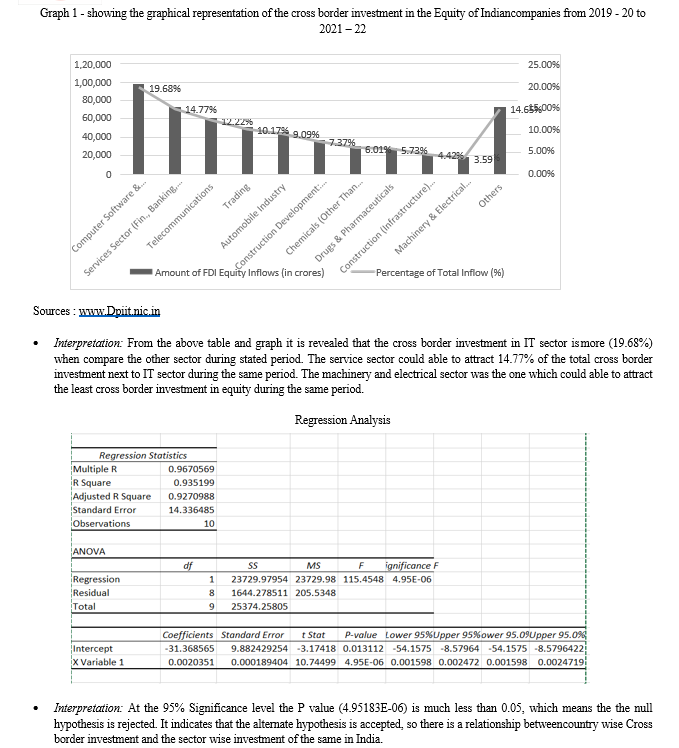

- From the above analysis it is found that the cross-border investment inflows in 2019- 20 is very low (i.e. 51.34 $million) when compare to the other years during stated period due to the impact of Covid situation. But in the year 2020 - 21 it was increased to 64.68$million and in the year 2021 – 22 it was further increased to 84.83$million, It is showing the evidence that year by year the cross border investment in the different sectors of Indian industry is showing increasing trend.

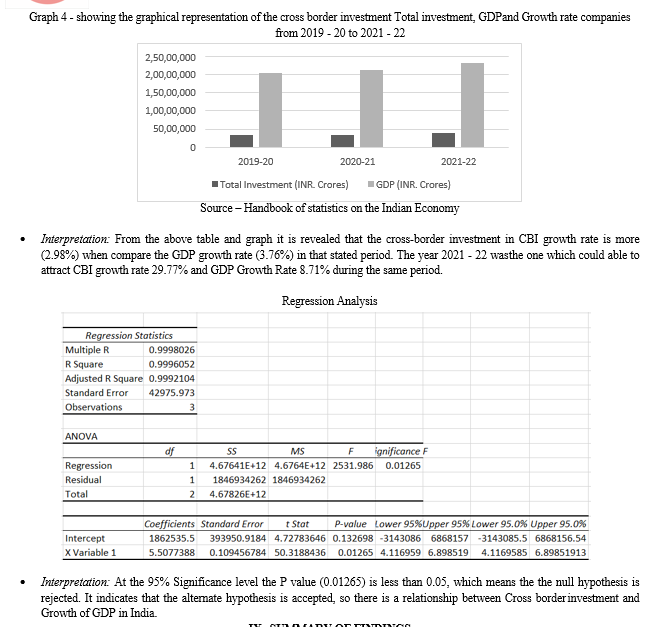

- When we compare growth rate of cross border investment with the growth rate of GDP there is a proportionate increase in GDP for every increase in cross border investment year by year during the stated study period.

References

[1] Cross-Border Investment and Development: Policy Perspectives by Stephany Griffith-Jones and José Antonio Ocampo (2012) [2] The Impact of Foreign Direct Investment on Economic Growth in India by S. K. Aggarwal and S. K. Goyal (2014) [3] Cross-Border Investment and the Transformation of India by Ashoka Mody (2016) [4] India\'s Emerging Role in Global Value Chains: The Impact of Cross-Border Investment by Homi Kharas and Aaditya Mattoo (2018). [5] \"The Impact of Cross-Border Investment on Economic Growth in India: A Time Series Analysis\" by R. K. Sinha and A. K. Pandey (2019). [6] \"Cross-Border Investment and the Manufacturing Sector in India\" by A. K. Jain and S. K. Aggarwal (2020). [7] \"The Impact of Cross-Border Investment on Employment in India: A Sectoral Analysis\" by R. K. Sinha and A. K. Pandey (2021). [8] Foreign Direct Investment and Productivity: Evidence from India\" by S. K. Aggarwal and A. K. Khandelwal (2022). [9] The Impact of Cross-Border Investment on Infrastructure Development in India\" by R. K. Sinha and A. K. Pandey (2023) [10] Cross-Border Investment and Environmental Impacts: Evidence from India\" by A. K. Jain and S. K. Aggarwal (2022). [11] \"The Impact of Cross-Border Investment on the Indian Rupee\" by R. K. Sinha and A. K. Pandey (2022). [12] \"The Impact of Cross-Border Investment on the Indian Stock Market\" by A. K. Jain and S. K. Aggarwal (2021). [13] https://www.india-briefing.com/news/india-Cross Border-inflow-2023-latest- data-analysis-on-investment-landscape-27821.html/ [14] www.india-briefing.com [15] www.oecd.org [16] www.toppr.com [17] www.accountlearn.com [18] WWW.Dpiit.nic.in

Copyright

Copyright © 2023 Tanya Singh, Himanshi Singh, Paras Kaushik, Dr. Amalanathan P. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET56275

Publish Date : 2023-10-24

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online